How Money Moves — And Why Real Estate Catches It

There’s a simple truth most investors overlook:

Money doesn’t disappear — it relocates.

It follows opportunity, yield, and stability.

When the economy shifts, money moves.

And when money moves, real estate reacts.

Today, we’re breaking down how the economy shapes real estate in 2026 — and what smart investors are doing right now.

💸 The Economic Chain Reaction

Every market cycle creates a behavioral shift:

Inflation rises → Cash loses strength

Interest rates climb → Borrowing slows down

Stocks turn volatile → Risk appetite drops

Investors search for security → Tangible assets look safer

This leads to one outcome:

Capital migrates into real estate.

Not because it’s perfect — but because it offers:

✔️ Price stability

✔️ Income potential

✔️ Inflation alignment

✔️ Tangible value

📊 Rental Yield Calculation (Example)

R E N T A L Y I E L D C A L C U L A T I O N

Property Price: $250,000

Annual Rent: $21,600

⬇️

Rental Yield = 8.64%

What that means:

4–6% → Standard in stable markets

6–8% → Solid / growth potential

8%+ → High-performance (verify sustainability)

A rental yield above inflation?

That’s how wealth compounds — even in uncertain conditions.

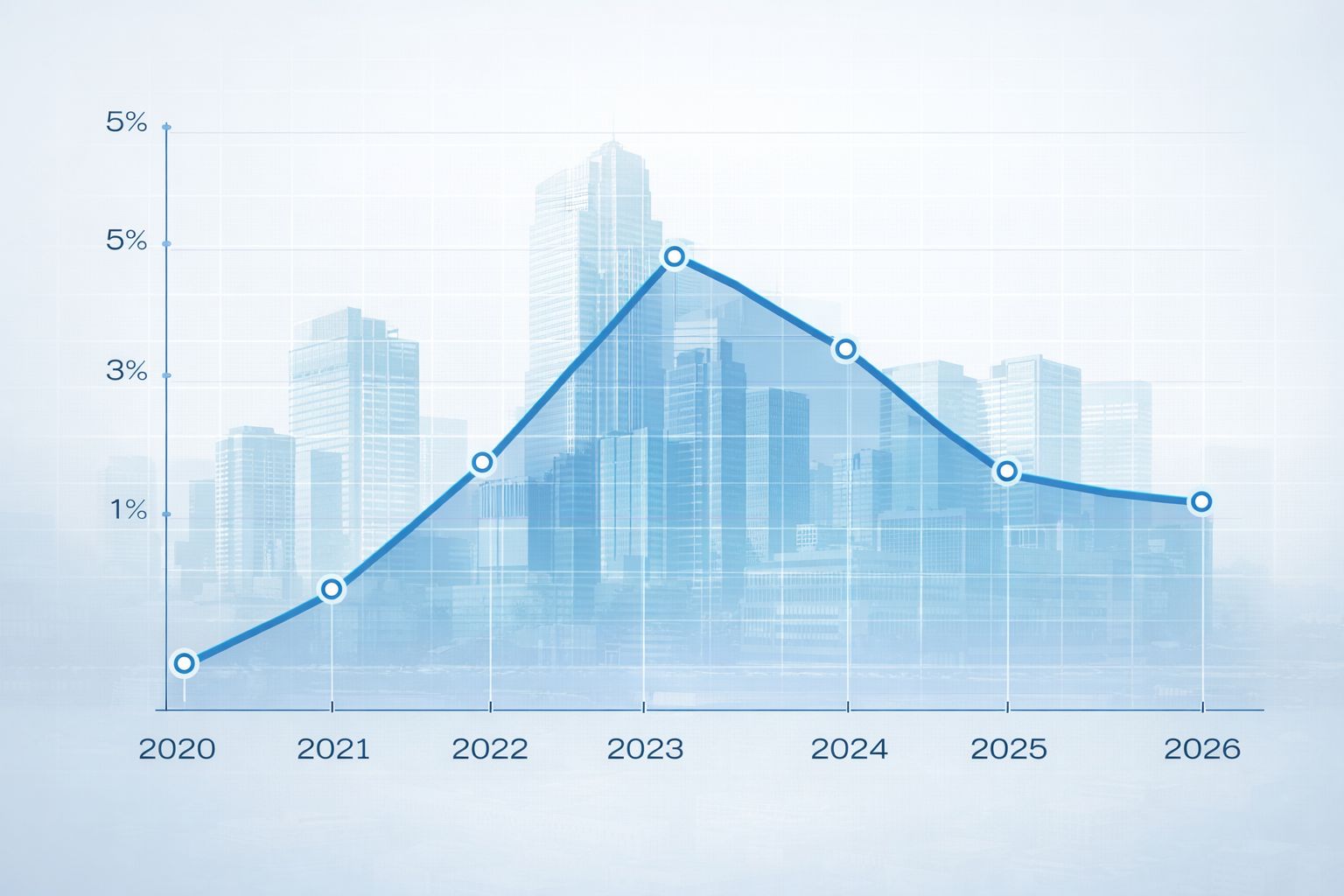

📈 U.S. Interest Rate Trend (2020–2026)

Year | Rate |

|---|---|

2020 | 0.25% |

2021 | 0.25% |

2022 | 2.00% |

2023 | 5.25% |

2024 | 5.00% |

2025 | 3.75% |

2026 | 3.75% |

What this means:

High rates = buyers pause → rentals strengthen

Lower rates later = buying demand rebounds

Investors entering early ride the appreciation wave

Real estate is slow-moving — and that’s the advantage.

You can see opportunities forming before they happen.

🧠 Why Real Estate Holds Power

Economic Trigger | Real Estate Response |

|---|---|

Inflation 🔺 | Rents & values often climb |

High rates 💳 | Rental market demand grows |

Job growth 👥 | Housing & commercial need rises |

Recession fears ⚠️ | Value investors step in |

This is why real estate is often used to:

Create wealth (renovation, development)

Protect wealth (ownership, rentals)

Transfer wealth (land, inheritance)

🚀 Where Smart Money Is Moving in 2026

Residential Rentals

→ Delayed homebuyers are boosting rental demand

Commercial Conversions

→ Vacant offices → multi-use + housing projects

Land Banking

→ Buy land near projected growth → hold → exit strategically

Luxury & Lifestyle Properties

→ Demand driven by high-net-worth migration patterns

🥅 The Rule of Economic Gravity

Money chases yield.

But it settles in stability.

Stocks create opportunity.

Crypto creates possibility.

Real estate creates security.

🔧 Action You Can Take Today

No matter your experience level, start here:

Beginner

✔️ Track interest rate changes monthly

✔️ Practice calculating rental yield

Intermediate

✔️ Compare 3 cities: price → rent → vacancy rates

✔️ Avoid deals below inflation yield

Professional

✔️ Target distressed commercial assets

✔️ Build acquisition plans around rate drops

The goal isn’t to time the market —

it’s to position yourself before the wave.

📩 Before You Go

If today’s issue helped you understand how money moves through the economy and into real estate…

👉 Share this with a friend who wants to invest smarter

👉 Subscribe to Sam Real Homes for weekly clarity

Because understanding the market isn’t optional — it’s leverage.

🔔 Subscribe Here

➡️ Sam Real Homes — Real Estate With Real Strategy