The Data Problem in Modern Markets

Markets today generate massive volumes of data every second:

Price movements across assets

Trading volume and liquidity changes

Economic releases and policy signals

Corporate filings and earnings reports

News and global events

For humans, analyzing all of this in real time is nearly impossible. AI helps by organizing, filtering, and prioritizing information.

How AI Helps With Trend Detection

AI systems are trained to identify patterns over time, not single events.

Instead of reacting to daily price changes, AI looks for:

Sustained momentum shifts

Repeating behavioral patterns

Changes in volatility and volume

This allows market participants to understand emerging trends earlier, without relying on guesswork or emotion.

Important note:

AI detects trends—it does not guarantee outcomes.

Faster and Deeper Data Processing

Traditional analysis relies on limited datasets. AI can process:

Historical price data

Cross-market relationships

Macro-economic indicators

Company-level fundamentals

By analyzing multiple data sources simultaneously, AI improves context, not certainty. This helps institutions and analysts see connections that would otherwise be missed.

Understanding Market Signals More Clearly

Market signals are subtle. They often appear as small shifts rather than dramatic moves.

AI helps identify:

Changes in investor sentiment

Unusual trading activity

Correlations between assets

Early risk indicators

Rather than replacing analysts, AI acts as a signal filter, helping humans focus on what matters most.

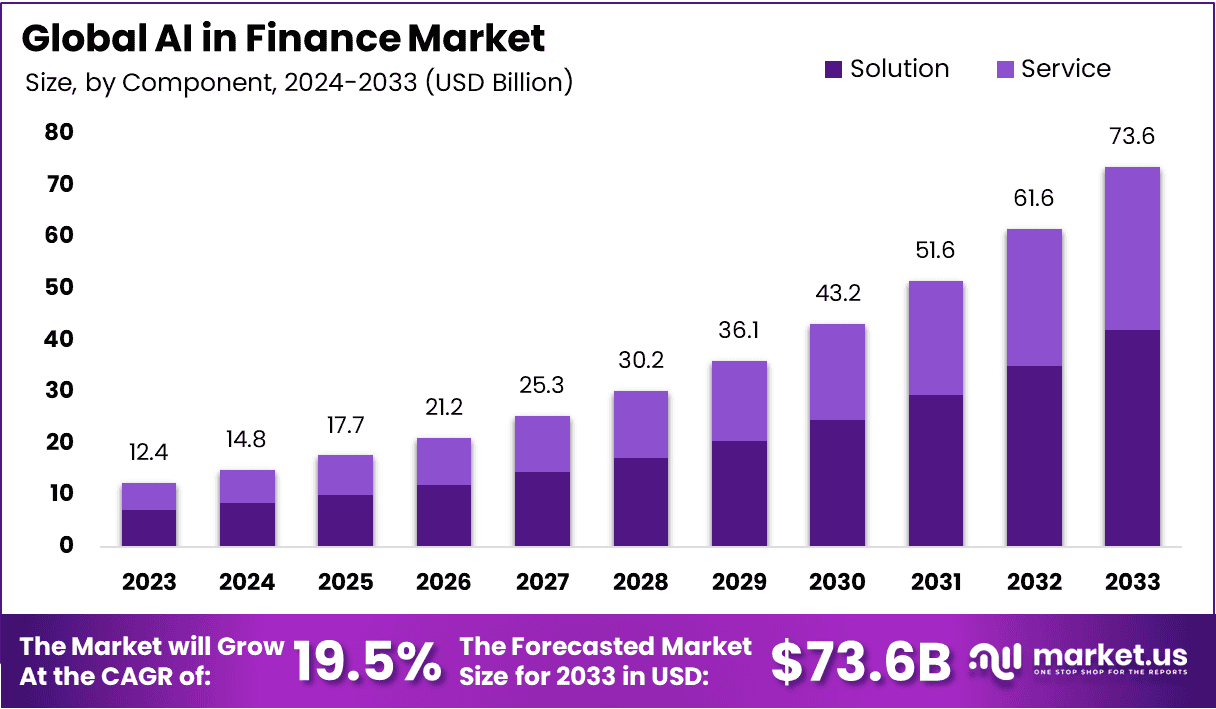

Why Financial Institutions Are Adopting AI

AI adoption isn’t about chasing trends—it’s about efficiency.

Financial firms use AI to:

Reduce manual analysis

Improve consistency in decision-making

Monitor markets continuously

Manage risk more effectively

This shift explains why AI is moving from an “advanced tool” to a standard part of market infrastructure.

What This Means for Everyday Investors

For individual investors, AI’s growing role means:

Markets react faster to information

Data-driven strategies are more common

Emotional decision-making matters even less

AI doesn’t eliminate risk—but it does raise the baseline of analysis across markets.

Why This Fits Market & Trends

✔ Explains how markets are evolving, not how to trade

✔ Focuses on tools and systems, not predictions

✔ Educational and long-term relevant

✔ Useful for both professionals and retail readers

Final Thought

AI isn’t replacing human judgment in financial markets—it’s reshaping how information is processed. As data continues to grow, AI’s role as a standard analytical tool will only become more important.

This newsletter is for informational purposes only and does not constitute investment advice.