⭐ 1. What Exactly Is a Credit Score?

A credit score is a three-digit number used by lenders to determine how risky it is to lend money to you.

Depending on your country, the scoring model may differ:

United States

FICO Score

VantageScore

United Kingdom

Experian

Equifax

TransUnion

Regardless of the system, the purpose is the same:

➡️ Predict how likely you are to repay borrowed money.

Most scores range from 300 to 850 (or their equivalent scale).

The higher the number, the more trustworthy you appear to lenders.

⭐ 2. Why Lenders Care So Much About Credit Scores

When you apply for a mortgage or personal loan, banks use your credit score to answer three basic questions:

1️⃣ Will this borrower repay the loan?

High score = more likely to repay.

Low score = higher risk.

2️⃣ How much interest should we charge?

Low score = higher interest

High score = lower interest

Even a 0.5% rate difference on a 30-year mortgage can cost you tens of thousands.

3️⃣ Should we approve or reject the application?

Some lenders use automatic systems.

If your score falls below a certain number, the system declines you instantly — no human review.

⭐ 3. Credit Score Ranges (and What They Mean)

Different lenders use different cutoffs, but generally:

Score Range | Category | Meaning |

|---|---|---|

800–850 | Exceptional | Best interest rates, fastest approvals |

740–799 | Very Good | Strong approval chances |

670–739 | Good | Approved by most lenders |

580–669 | Fair | Higher interest, more restrictions |

300–579 | Poor | Very difficult to get approved |

Your rate can change dramatically between these categories.

⭐ 4. How Credit Score Affects Mortgage Loan Approval

When applying for a mortgage, lenders look at more than just income. Your credit score is one of the top three factors they consider.

Here’s how it impacts your approval chances:

✔️ 720+ — Strong Approval Odds

Lower interest rates

Smaller down-payment options

More loan programs available

Faster underwriting process

✔️ 660–719 — Moderate Approval Odds

Still eligible for conventional loans

Slightly higher interest rates

May require additional documentation

Some lenders may request a bigger down payment

✔️ 580–659 — Limited Approval

You may still qualify for:

FHA loans (U.S.)

Low-credit borrower programs

But expect higher rates and fees

✔️ Below 580 — High Risk Category

Approval becomes difficult because lenders see:

Higher likelihood of missed payments

Higher default risk

Lower credit history quality

In many cases, lenders will ask you to:

Bring a co-signer

Increase down payment

Or spend several months improving your score

⭐ 5. How Credit Score Impacts Mortgage Interest Rates

This is the part many people overlook — and it’s the most expensive mistake.

Let’s illustrate the difference.

Example:

Loan Amount: $300,000

Term: 30 years

Country: US (Typical FICO tiers)

Credit Score | Estimated Rate | Monthly Payment | Extra Paid Over 30 Years |

|---|---|---|---|

760+ | 6.1% | $1,815 | — |

700–759 | 6.4% | $1,874 | +$21,000 |

660–699 | 7.2% | $1,999 | +$66,000 |

620–659 | 7.9% | $2,170 | +$128,000 |

Just moving from 660 → 700 can save you over $45,000 over the loan term.

Your credit score is not just a number—

➡️ It’s a long-term cost multiplier.

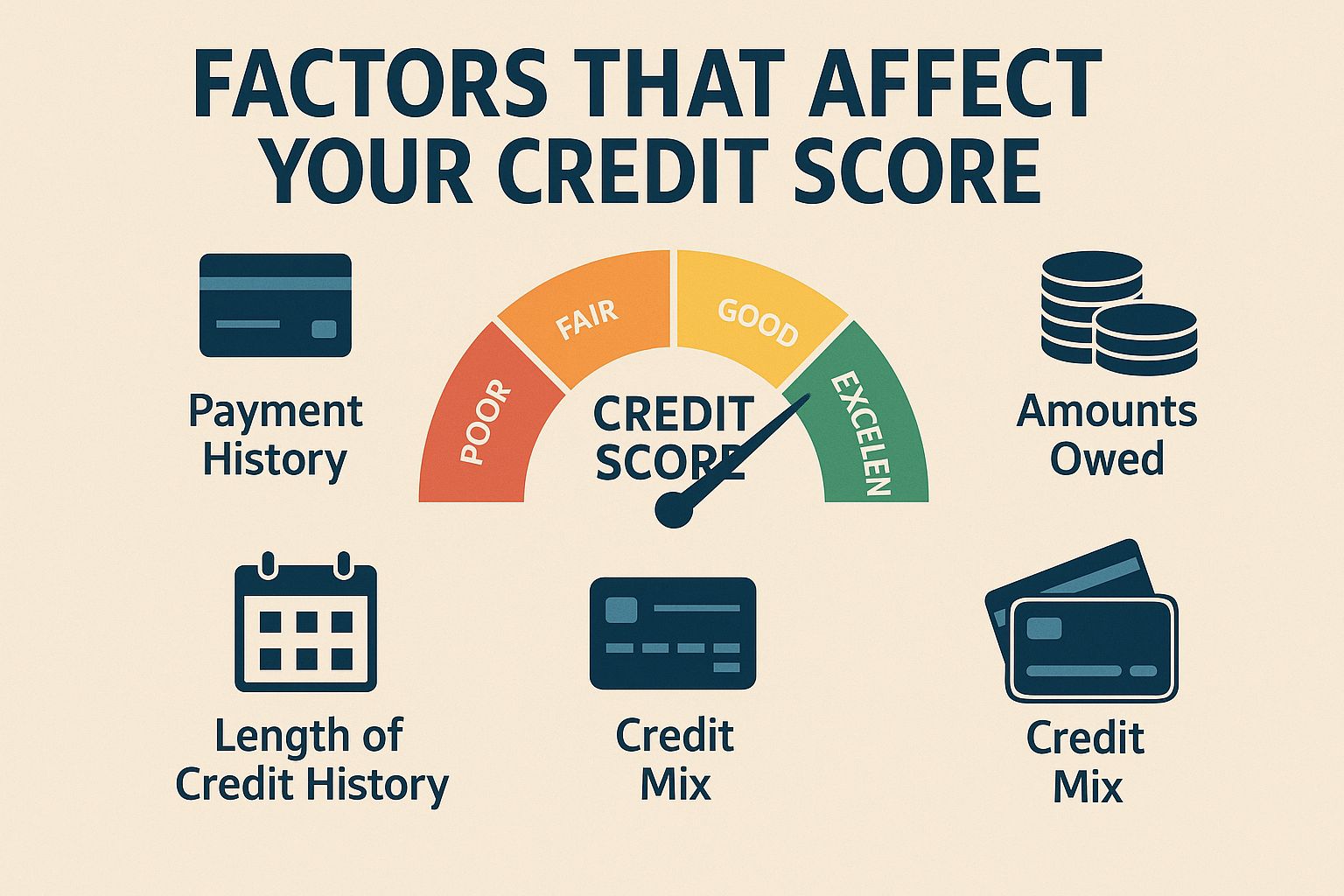

⭐ 6. Factors That Affect Your Credit Score

Your credit score is calculated using several components:

🔹 1. Payment History (35%)

This is the most important factor.

Late payments, missed payments, or defaults hurt your score dramatically.

🔹 2. Credit Utilization (30%)

How much of your available credit you use.

Example: If you have a $10,000 limit and use $8,000 → 80% utilization (too high).

Ideal usage: Under 30%.

🔹 3. Length of Credit History (15%)

Older accounts = better score.

Closing old accounts can hurt you.

🔹 4. Credit Mix (10%)

Lenders prefer a mix of:

Credit cards

Personal loans

Auto loans

Mortgage loans

🔹 5. Hard Inquiries (10%)

Every time you apply for credit, a hard check is added.

Too many checks in a short time lowers your score.

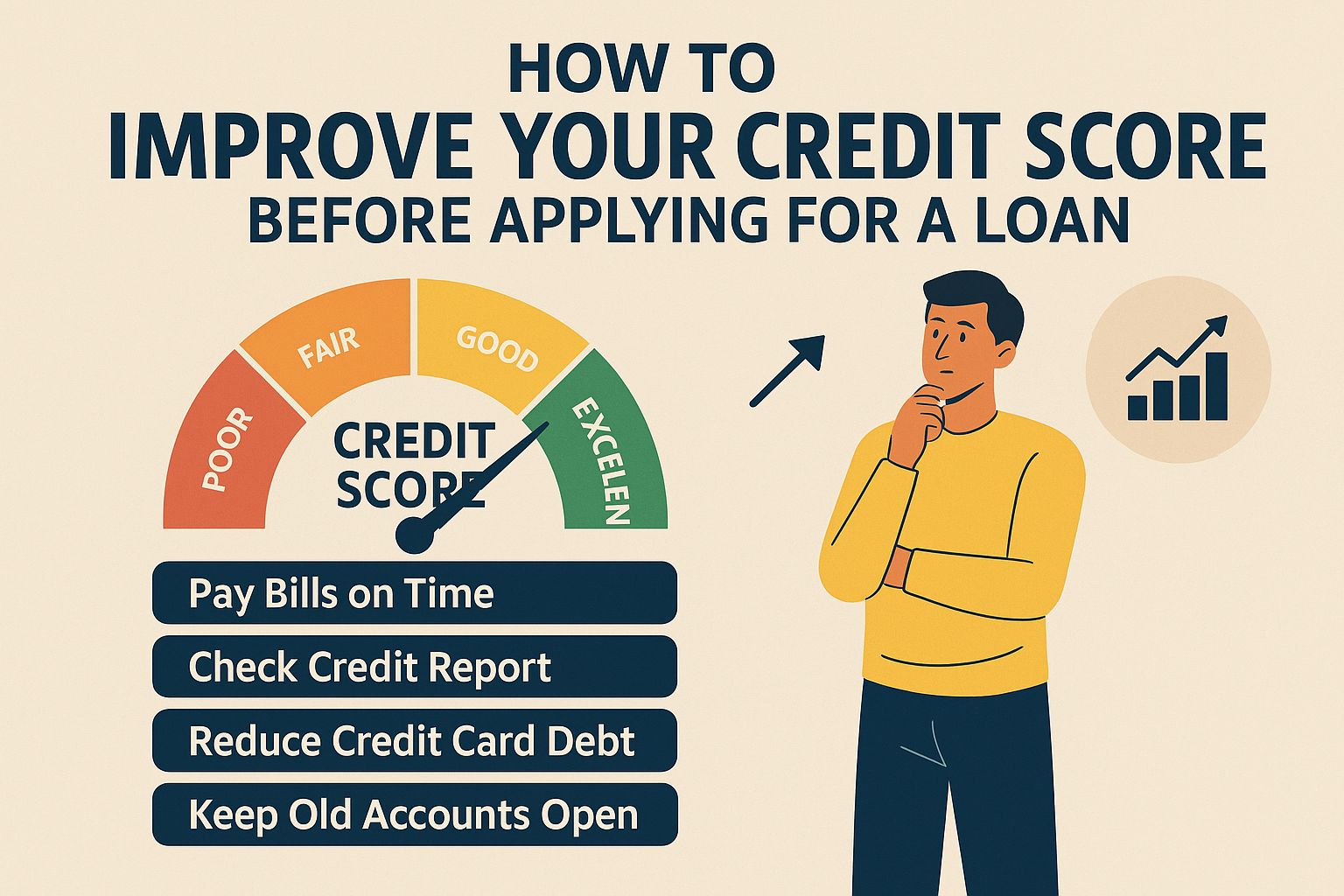

⭐ 7. How to Improve Your Credit Score Before Applying for a Loan

You can often improve your score within 60–120 days using these tactics:

✔️ 1. Pay Down Credit Card Balances

Lowering utilization gives the fastest score boost.

✔️ 2. Dispute Incorrect Credit Report Items

Errors are common.

Removing just one wrong late payment can boost your score 30–60 points.

✔️ 3. Avoid Hard Credit Checks

Stop applying for new cards/loans at least 3 months before your mortgage application.

✔️ 4. Keep Old Accounts Open

Even unused accounts help your credit age.

✔️ 5. Pay Every Bill on Time

One late payment can drop your score 70–100 points.

If a family member has a strong credit card history, their positive record can help boost your score.

✔️ 7. Build Credit with Secured Cards

Perfect for rebuilding credit.

⭐ 8. Common Myths About Credit Scores

❌ Myth 1: Checking my score lowers it

Truth: Checking your own score is a soft inquiry. It does NOT affect your score.

❌ Myth 2: Income affects credit score

Income is important for loan approval — but not part of the credit score formula.

❌ Myth 3: Closing cards improves your score

Closing accounts shortens your credit history → hurts your score.

❌ Myth 4: Paying off a loan instantly boosts your score

Not always. It can temporarily decrease your score because you lose an active account.

⭐ 9. Final Thoughts: Your Credit Score Is a Financial Power Tool

Your credit score determines:

Whether you get approved

What interest rate you pay

How much money you keep or lose over time

How lenders view your financial stability

Think of your credit score as a long-term investment.

Improving it—even by a small amount—can save you thousands over the next few years.

If you're planning to apply for a mortgage, refinancing, or making a major purchase, start improving your score today, not when you’re already at the loan office.

YOU CAN ALSO JOIN THEIR NEWSLETTER IF YOU NEED MORE UPDATE ABOUT REAL ESTATE!

Earn Your Certificate in Real Estate Investing from Wharton Online

The Wharton Online + Wall Street Prep Real Estate Investing & Analysis Certificate Program is an immersive 8-week experience that gives you the same training used inside the world’s leading real estate investment firms.

Analyze, underwrite, and evaluate real estate deals through real case studies

Learn directly from industry leaders at firms like Blackstone, KKR, Ares, and more

Earn a certificate from a top business school and join a 5,000+ graduate network

Use code SAVE300 at checkout to save $300 on tuition $200 with early enrollment by January 12.

Program starts February 9.

💬 Enjoyed this issue?

If you found this helpful, consider sharing it with someone who’s planning to buy a home or apply for a loan soon.

Want next week’s issue?

Subscribe to get more finance + mortgage insights directly to your inbox.