If you found this guide helpful, hit Subscribe so you never miss my future newsletters on:

Home buying

Mortgage hacks

Credit score boosting tricks

Real-estate investing strategies

📩 Stay informed. Stay prepared. Become mortgage-ready.

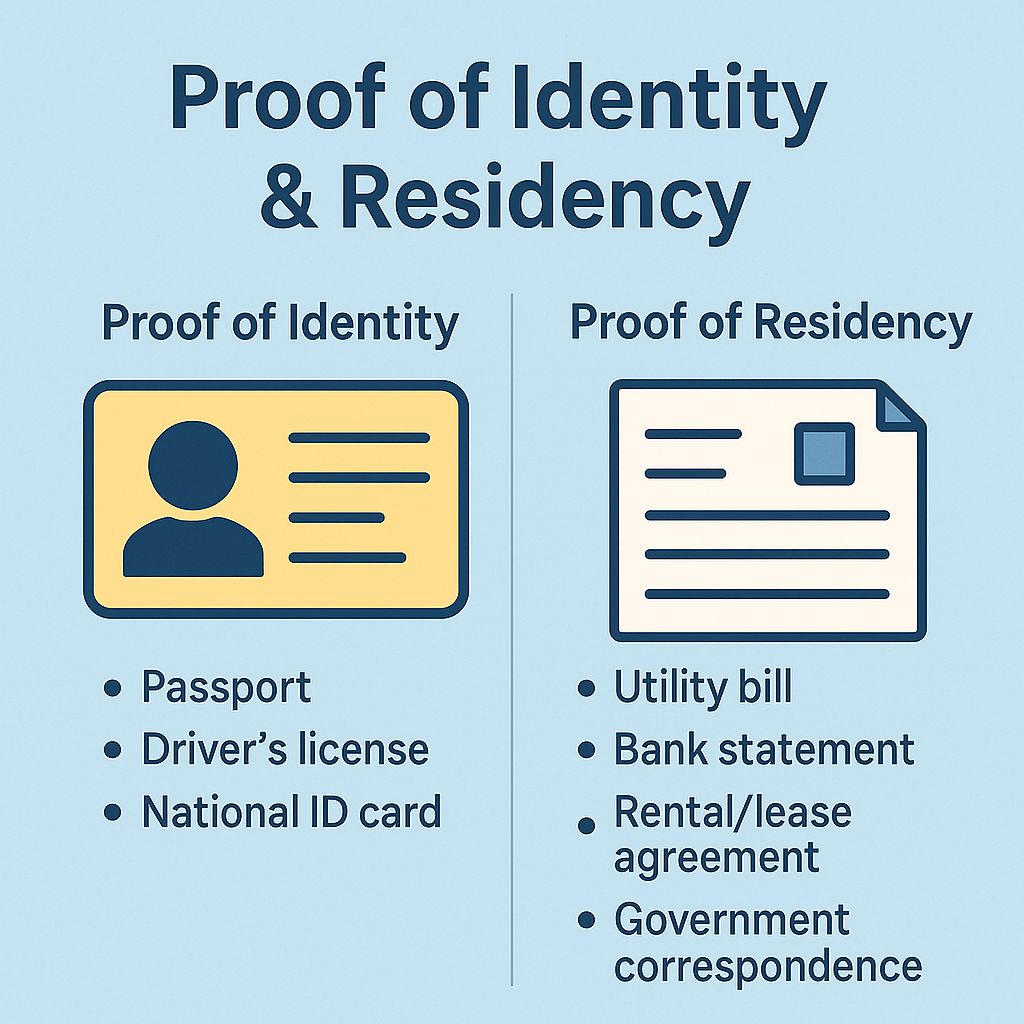

Proof of Identity

✅ What It Means When Lenders Ask for “Proof of Identity & Residency”

When a lender asks you for Proof of Identity & Residency, they are simply verifying two things:

1️⃣ Proof of Identity — Who you are

They need to confirm your legal identity before they can review your finances or pull your credit report.

Common accepted documents:

Passport

Driver’s license

National ID card

Government-issued photo ID

2️⃣ Proof of Residency — Where you currently live

Even if your ID has an address, lenders often need separate documents showing your current residence.

Common accepted documents:

Utility bill (electricity, gas, water, internet)

Bank statement with your address

Rental/lease agreement

Government correspondence

Credit card statement

These must have your name + current address + recent date (usually within 60–90 days).

⭐ Why They Ask for This

Mortgage lenders must verify your identity and residence for:

Fraud prevention

Anti–money laundering compliance

Credit report matching

Ensuring all your documents link to the same person

💡 What You Should Submit (Best Practice)

Send clean, clear PDFs of:

One identity document

One residency document

Do not send screenshots or blurry images.

📄 Example of What a Lender Might Say:

“Please provide proof of your identity and current residential address for mortgage verification.

Acceptable ID: passport, driver’s license, or government ID.

Acceptable residency documents: utility bill, bank statement, or lease agreement dated within the last 60 days.”