📊 The Big Picture

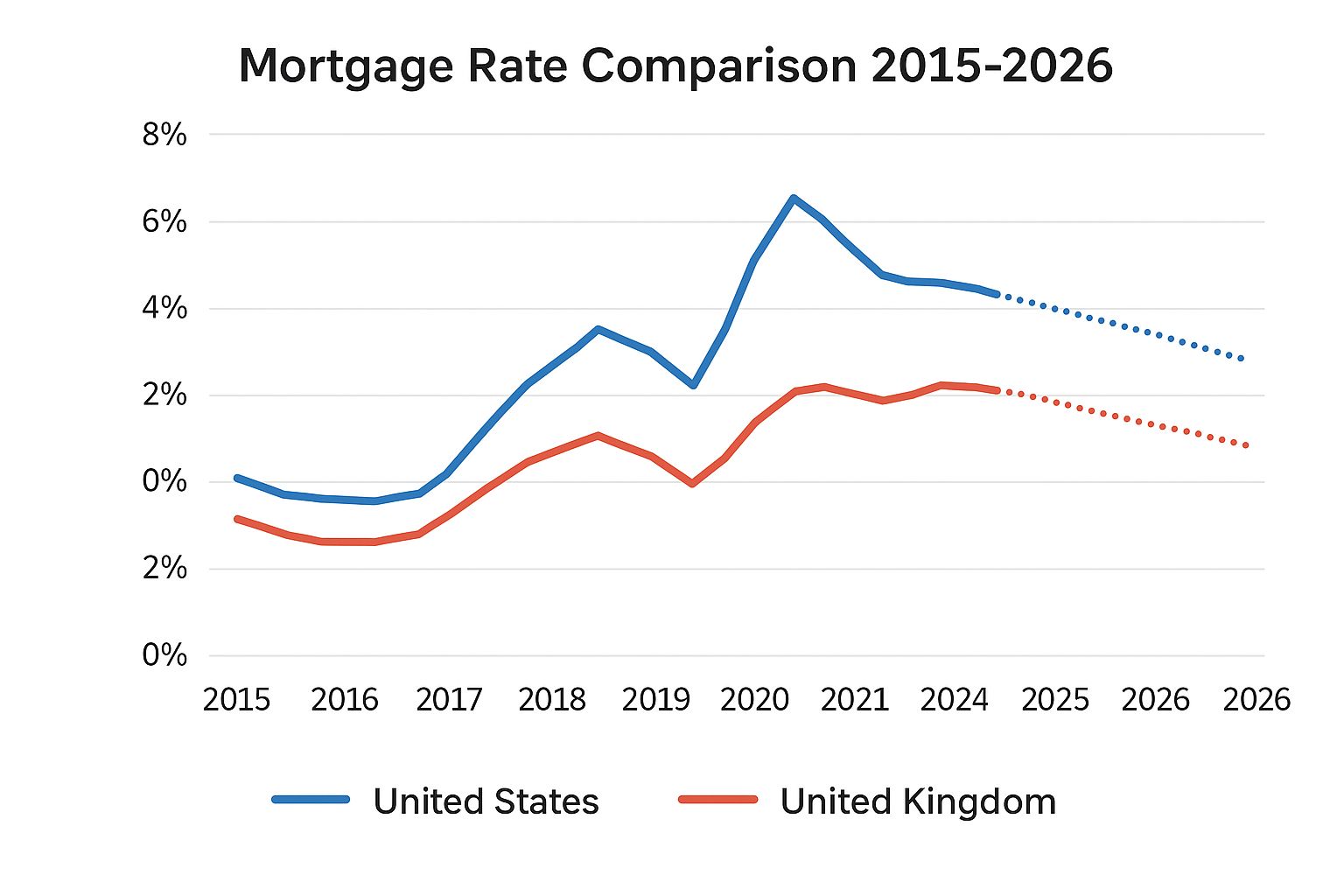

Mortgage rates have been on a wild ride. From pandemic-era lows to recent highs driven by inflation and central-bank tightening, both the U.S. and U.K. housing markets have felt the pinch.

Understanding these trends could help you lock in a better rate or plan your next investment move wisely.

🇺🇸 U.S. Mortgage Rate Trends (2021–2026

Year | Avg. Rate | Trend |

|---|---|---|

2021 | 3.0% | 📉 Historically low |

2022 | 5.3% | 🔼 Inflation heats up |

2023 | 7.8% | 🔼 Fed’s peak hikes |

2024 | 6.7% | 📉 Stabilization begins |

2025 | 6.4% | 📉 Slight recovery |

2026 (Forecast) | 5.8% |

💡 Tip: Buyers who can refinance later may still find opportunities in 2025 as rates ease.

🇬🇧 U.K. Mortgage Rate Trends (2021–2026)

Year | Avg. Rate | Trend |

|---|---|---|

2021 | 2.5% | 📉 Post-pandemic lows |

2022 | 3.9% | 🔼 BoE tightening |

2023 | 6.5% | 🔼 Peak pressure |

2024 | 5.7% | 📉 Cooling market |

2025 | 5.1% | 📉 Gradual relief |

2026 (Forecast) | 4.5% | 📉 Predicted decline |

📈 Visual Snapshot

💬 Expert Insight

Economists expect moderate rate relief through 2025 as the Fed and Bank of England ease back from tightening.

While home prices may stay steady, improving affordability could boost demand again — especially in suburban and mid-tier markets.

💡 What This Means for You

✅ Buyers: Lock short-term rates, refinance later when rates drop.

🏠 Homeowners: Monitor refinancing options in late-2025.

💰 Investors: Falling rates could raise property demand again.

🧾 Helpful Tools

🚀 Next Issue Preview

📅 Coming soon → “Real Estate Rebound 2025: Where Buyers Are Gaining the Edge”

✨ Don’t miss it — subscribe for early access.

🏡 Follow & Connect

👉 Facebook: facebook.com/SamRealHomes

🌐 Website: newsletter.sam-realhomes.com

✉️ Stay Updated

💌 Get weekly and Daily real estate insights, trends, and tools directly in your inbox.

🔸 Subscribe now — it’s free!