You submitted everything. You waited days or weeks. You were excited.

Then—boom—your mortgage application was rejected.

The worst part?

Lenders rarely tell you the full story.

Instead, you get vague reasons like:

❌ “High risk profile”

❌ “Insufficient credit strength”

❌ “Does not meet lending criteria”

But why did it actually happen?

Today’s deep dive uncovers the real, behind-the-scenes reasons lenders decline mortgage applications — the things they analyze that borrowers never see. Once you understand these hidden rules, you’ll know exactly how to fix them and come back with a stronger application.

A mortgage approval isn’t just about your income and credit score. Behind the scenes, lenders run dozens of checks — financial, behavioral, historical, and even psychological patterns based on millions of past borrowers.

Most rejections fall into eight major categories. Some are obvious. Many aren’t.

Let’s break down each one clearly and simply.

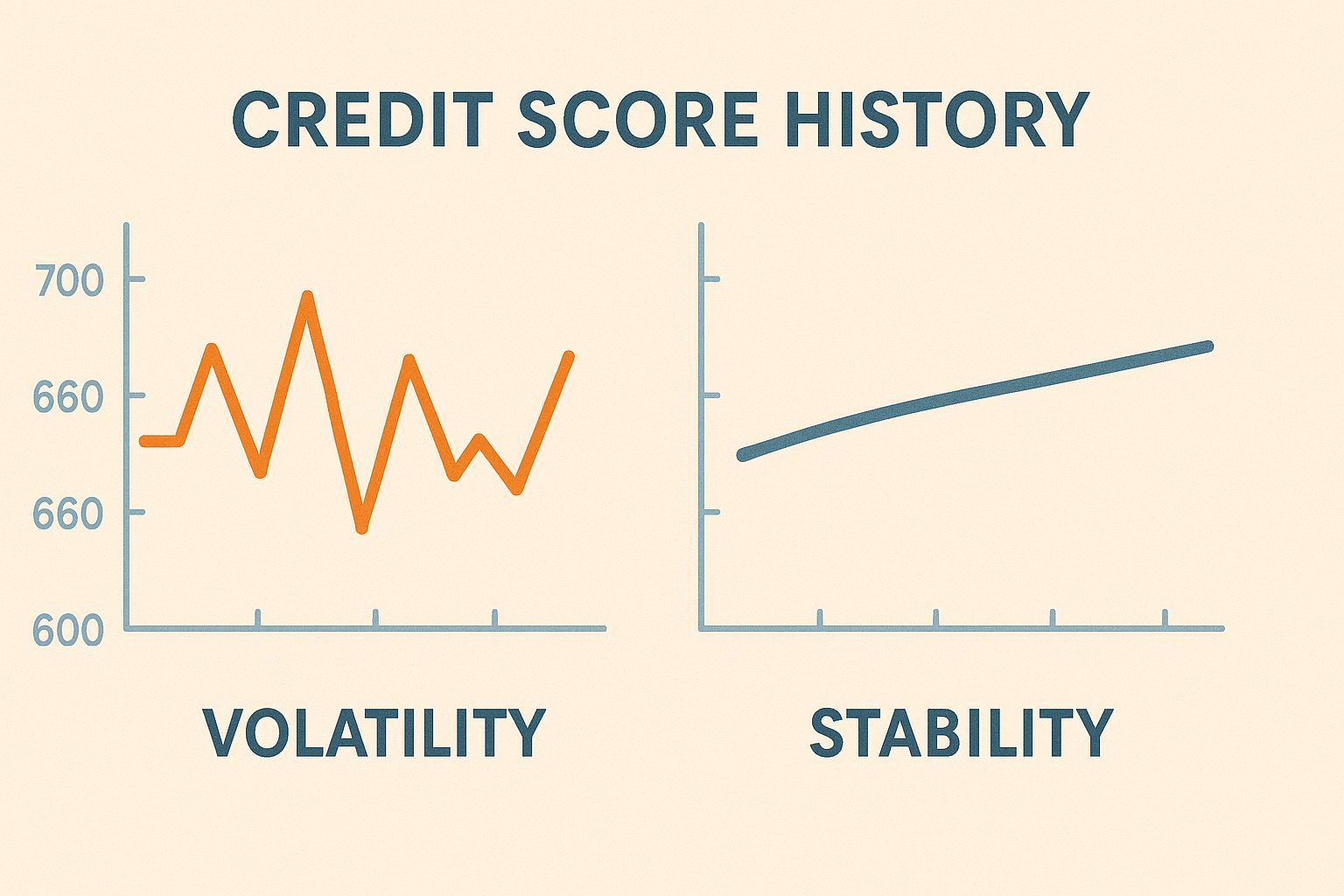

1. Your Credit Profile Shows “Instability,” Not Just Low Score

Lenders don’t just check your credit score.

They check the story behind your score.

Here’s what they look for:

🔍 Red flags they won’t say out loud

Multiple credit inquiries within 90 days

Recent late payments (even 30 days late)

Using more than 30% of your credit limit

Recently opened credit cards

Closing old accounts that shorten your credit history

Large, unexplained balances suddenly appearing

Authorized user accounts that inflate your score but not your creditworthiness

Even if your score is decent, lenders can reject you because the pattern looks risky.

Example:

Two applicants can have a 680 score.

One gets approved.

One gets denied.

Why?

Because one has a stable 5-year history.

The other opened 3 credit cards in the last 4 months.

Lenders care more about consistency than perfection.

2. Your Income Looks “Unreliable” on Paper

Even if your income seems high, lenders may see it as risky.

🚫 Types of income lenders flag:

Commission-heavy jobs

Cash-based income that can’t be verified

Gig work without 2 years of tax returns

Self-employed income that fluctuates year to year

Overtime/bonus pay without a long enough history

📌 A shocking detail:

Even if your current income is stable now, lenders need a minimum 24-month history for many income types.

If it doesn’t meet that rule?

Automatic rejection — even if you make plenty.

3. Your Bank Statements Show Behaviors Lenders Hate

Lenders actually review your last 3–6 months of bank statements line by line.

What they look for:

Unexplained cash deposits

Large transfers to individuals

Gambling transactions

Overdrafts

A negative balance at any point

High daily spending compared to income

Sudden income spikes that look temporary

Venmo/Cash App transfers that seem “informal”

Even if everything is legal, these habits create a risk profile lenders avoid.

❗ Did you know?

Just one overdraft in the last 6 months can cause an underwriter to reject you — even if your credit score is excellent.

4. Your Debt-to-Income (DTI) Ratio Is Too High (Even If You Think It’s Fine)

Most borrowers only calculate the basic DTI.

But lenders calculate a lender version of DTI that includes:

Future property taxes

Homeowner’s insurance

HOA dues (if applicable)

PMI (if your down payment is low)

Undisclosed debts on your bank statements

Co-signed loans

Student loans (even if in deferment)

So even if you think your DTI is 35%, the lender’s DTI calculation might be 50%.

And many lenders automatically reject anything above 43%.

5. Your Down Payment Source Raised Questions

Lenders don’t just want the money —

they need to confirm where it came from.

Rejection triggers:

Cash deposits

Gift money without a properly documented gift letter

Crypto-liquidated funds

Recently borrowed money that looks like debt disguised as cash

Transfers from an account with unknown origin

Money moving between too many accounts within 60 days

Lenders need a clear paper trail. If the money’s origin isn’t 100% documented, they decline the file.

6. Your Employment History Doesn’t Show “Stability”

You may think switching jobs is normal.

Lenders may see it as risk.

They want:

2 years in the same industry

No unexplained employment gaps

No switching from salaried → self-employed

No switching from W2 → 1099

No short-term contract jobs without renewal history

Instant red flag:

If you changed jobs in the middle of the mortgage process.

Even if it's a higher salary, it may cause delays or rejection if documentation doesn’t match lending guidelines.

7. Your Property Didn’t Pass the Lender’s Standards

Sometimes your financials are fine —

but the property is not.

Lenders reject homes because:

Appraisal comes in too low

Home is in poor condition

Unpermitted work on the property

Property is in a declining neighborhood

Condo has HOA financial problems

Too many units in the complex are rented out

Property is considered an investment risk zone

You may have done everything right, but the property fails on the backend.

8. Your File Looks Too “Complex” for the Lender’s Risk Appetite

Even if everything is technically acceptable, lenders may still decline if your profile looks non-standard.

Examples:

You earn income in three different countries

You have multiple businesses

You work freelance for many clients

You own multiple rental properties

You have a recent divorce

Your taxes involve advanced deductions

Your financials require too much documentation

If underwriting thinks your file is too complicated, they may reject simply because it costs them too much time and risk to approve it.

The Real Reason Lenders Don’t Tell You Everything

Lenders are legally allowed to give only general reasons for rejection.

They don’t disclose the full details because:

It protects their internal scoring models

It avoids legal disputes

They don’t want to reveal proprietary risk algorithms

They avoid saying anything that could be interpreted as discrimination

They want to prevent borrowers from “gaming the system”

This is why you get vague answers like:

“We are unable to offer financing at this time.”

But underneath, there are usually multiple hidden reasons working together.

🛠️ Actionable Checklist to Fix a Rejected Mortgage Application

Here’s how to rebuild your application into one lenders will approve.

1. Clean up your bank statements (60–90 days)

✔ No overdrafts

✔ No cash deposits

✔ Keep balance consistent

✔ Avoid large unexplained transfers

✔ Reduce discretionary spending

2. Fix your credit profile the smart way

✔ Pay down cards to under 30% utilization

✔ Remove authorized user accounts inflating your score

✔ Avoid new credit inquiries for 90 days

✔ Bring any late payments up to date

✔ Dispute incorrect negative items

3. Strengthen your income documentation

✔ Gather 2 years of tax returns

✔ Get employer verification letters ready

✔ Show consistent earnings

✔ If self-employed → prepare profit & loss statements

✔ Avoid switching jobs during the loan process

4. Lower your DTI immediately

✔ Pay off small loans

✔ Refinance high-interest debt

✔ Remove yourself as co-signer (if possible)

✔ Avoid taking on any new debt

✔ Delay major purchases

5. Stabilize your down payment funds

✔ Keep money in one account

✔ No movement for 60 days

✔ Use gift funds only with a proper gift letter

✔ Avoid crypto / undocumented sources

6. Choose the right lender for your profile

Not all lenders treat files the same.

Some specialize in:

Self-employed borrowers

Low credit borrowers

High DTI borrowers

First-time homebuyers

Non-standard income files

Applying with the wrong lender can guarantee rejection.

7. Get pre-underwritten before shopping

This is stronger than pre-approval.

It means an actual underwriter reviews your income, credit, and documents early.

This alone increases approval chances by 3x.

If you found this breakdown helpful and want more insider-level mortgage, credit, and homebuying insights…

👉 Subscribe to get weekly guides lenders never tell you about.

Straightforward advice. Zero fluff. Real strategies that save you thousands.

Join the community — your smarter homebuying journey starts now.